Here’s the truth nobody wants to tell you about crypto trading timeframes: there’s no magic bullet. No guru can point to the 15-minute chart and say, “That’s your golden ticket to riches.” Anyone who tells you otherwise is probably trying to sell you something.

But here’s what I can tell you after years in these markets – some timeframes will absolutely work better for your situation than others. The key is matching your timeframe to your lifestyle, not chasing some fantasy of quick profits.

The Reality Check: Matching Timeframes to Your Life

Let’s get practical for a moment. If you’re grinding through a 9-to-5 job, staring at 5-minute charts isn’t just impractical – it’s a recipe for disaster. You’ll end up making emotional trades during lunch breaks or sneaking peeks at your phone during meetings. That’s not trading; that’s gambling with extra stress.

For working professionals, daily and weekly charts become your best friends. You get your market information after hours, make your decisions with a clear head, and execute your plan without workplace distractions. It’s trading that fits your life, not the other way around.

On the flip side, if you have the luxury of time – maybe you’re self-employed, between jobs, or genuinely committed to making trading your full-time gig – then shorter timeframes open up a world of opportunities. But remember, with greater frequency comes greater responsibility for risk management.

The Three Pillars of Trading Styles

Day Trading: The Sprint

Day trading is exactly what it sounds like – in and out within the same trading session. You buy Bitcoin at 10 AM, sell it at 2 PM, and by market close, you’re flat. No overnight positions, no weekend worry about what news might hit while you’re sleeping.

The appeal is obvious: quick results, defined risk periods, and the ability to compound small gains rapidly. The reality? It’s mentally exhausting, requires constant attention, and the transaction costs can eat you alive if you’re not careful.

Swing Trading: The Sweet Spot

Most successful retail traders I know are swing traders, and there’s a good reason for that. Swing trading typically involves holding positions for anywhere from a few days to a couple of weeks. It’s the Goldilocks zone – not too fast, not too slow, but just right for most people.

You can set your trades, place your stop-losses and take-profit orders, and actually have a life outside of charts. When Bitcoin pulls back to a support level, you buy it, set your risk parameters, and let the market do its thing. No need to babysit every tick.

Long-term Investing: The Marathon

Then there are the HODLers – the buy-and-hold crowd who treat crypto like digital real estate. They’re not worried about daily fluctuations or even monthly corrections. They’re betting on the long-term adoption and value appreciation of their chosen cryptocurrencies.

This approach requires the least active management but demands the most patience and conviction. It’s not exciting, but historically, it’s been one of the most profitable approaches for patient investors.

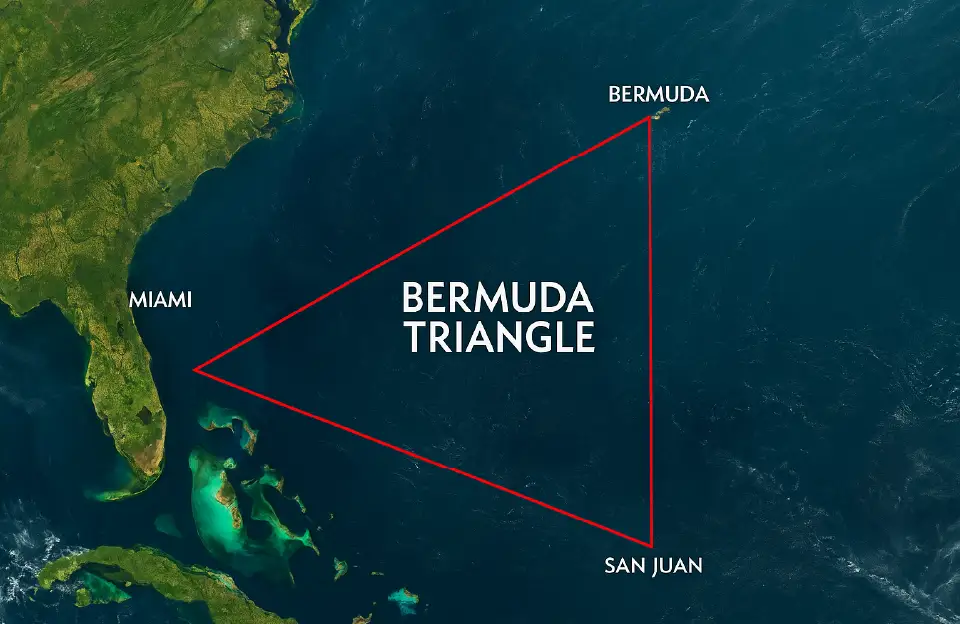

Multiple Timeframe Analysis: Seeing the Full Picture

Here’s where most traders go wrong – they pick one timeframe and stick to it religiously, missing the bigger picture entirely. Professional traders use multiple timeframe analysis, and it’s simpler than it sounds.

Think of it like zooming in and out on a map. The weekly chart shows you the neighborhood (the major trend), the daily chart shows you the street (intermediate movements), and the hourly chart shows you the exact address (entry and exit points).

The Weekly View: Your North Star

Bitcoin’s weekly chart tells the most important story. If it’s been climbing steadily for months, forming higher highs and higher lows, that’s your dominant trend. Fighting this trend is like swimming upstream – possible, but exhausting and usually unprofitable.

I’ve watched countless traders see Bitcoin’s weekly uptrend and think, “It’s gone too far, too fast. Time to short it.” That’s a great way to get steamrolled. The trend is your friend until it clearly isn’t, and weekly charts don’t lie about the big picture.

The Daily Chart: Your Strategic Level

Once you know the weekly trend, the daily chart becomes your strategic planning tool. If Bitcoin is in a weekly uptrend but has pulled back on the daily chart, that’s not a reason to panic – it’s a potential buying opportunity.

This is where you start looking for those classic technical patterns: support and resistance levels, candlestick formations, and momentum indicators. The daily chart bridges the gap between the big picture and your actual trading decisions.

The Hourly and Lower: Your Tactical Execution

When you’ve identified the trend (weekly) and found your general area of interest (daily), the hourly and lower timeframes help you fine-tune your entries and exits. This is where you get granular with your risk management.

But here’s the crucial part – never let the lower timeframes override the higher ones. If Bitcoin is in a weekly uptrend but shows a temporary downtrend on the hourly chart, you’re still looking for buying opportunities, not selling opportunities.

The Timeframe Hierarchy in Action

Let me give you a real-world example that plays out constantly in crypto markets. Bitcoin’s weekly chart shows a clear uptrend – higher highs, higher lows, the works. But novice traders see a red day or two on the daily chart and panic.

What they’re missing is context. Those daily pullbacks within a weekly uptrend aren’t sell signals – they’re buying opportunities. Smart money waits for these pullbacks, then steps in at better prices.

This is why successful traders always check their timeframes in order: weekly for trend, daily for context, hourly for precision. It’s like building a house – you need a solid foundation (weekly trend) before you worry about the finishing touches (hourly entries).

Day Trading: The Double-Edged Sword

If you’re determined to day trade crypto, understand what you’re signing up for. Those 5-minute and 15-minute charts can be incredibly profitable, but they’re also where most traders blow up their accounts.

The advantage of day trading is obvious: smaller stop-losses mean smaller individual losses, and you can compound gains quickly when you’re right. The disadvantage? You need to be right more often, and the psychological pressure is intense.

Day trading in crypto is especially challenging because these markets never close. Unlike traditional markets with clear opening and closing bells, crypto runs 24/7, which means news, whale movements, and market sentiment can shift dramatically while you’re sleeping.

Swing Trading: The Professional’s Choice

Swing trading hits the sweet spot for most people because it aligns with how institutional money actually moves. Big players can’t get in and out of positions in minutes – they need days or weeks to accumulate or distribute their holdings.

When you swing trade, you’re essentially riding the coattails of these bigger movements. You identify the trend, wait for a pullback, enter your position, and let the market do the heavy lifting.

The beauty of swing trading is that you can have a life outside of trading. Set your stop-loss, define your profit target, and let probability work in your favor. You’re not glued to screens all day, which means better decision-making and less emotional trading.

The Pitfalls of Fighting the Trend

Here’s where I see traders consistently lose money: they identify the correct trend but try to be too clever with their timing. Bitcoin is in a clear weekly uptrend, but they see a red hourly candle and think they’ve spotted a reversal.

This kind of thinking leads to what I call “clever money syndrome” – being so focused on finding the perfect entry that you miss the obvious trade. Sometimes the best trade is the most obvious one: buying strength in an uptrend and selling weakness in a downtrend.

Remember, trends persist longer than most people expect. Just when everyone thinks Bitcoin has gone “too far, too fast,” it often goes further and faster. Respect the trend until it clearly changes, not until you think it should change.

Volatility and Timeframe Selection

Different cryptocurrencies exhibit different volatility patterns, and this should influence your timeframe selection. Bitcoin, being the most mature crypto asset, tends to have smoother trends that work well with longer timeframes.

Altcoins, especially smaller ones, can be incredibly choppy. What looks like a clear trend on a daily chart might be just noise when you zoom out to the weekly. This is why many successful altcoin traders prefer shorter timeframes – the trends don’t last as long, so you need to capture them more quickly.

Ethereum often sits in the middle – more volatile than Bitcoin but more stable than most altcoins. This makes it suitable for various timeframe approaches, depending on market conditions and your personal style.

The Noise Factor

Lower timeframes come with more noise – random price movements that don’t reflect genuine market sentiment. It’s like trying to identify a song while standing next to a construction site. The signal is there, but the noise makes it harder to hear.

As you move to higher timeframes, the noise decreases, and the genuine trends become clearer. This is why many professional traders make their strategic decisions on higher timeframes and only use lower timeframes for tactical execution.

Building Your Timeframe Strategy

Start with your lifestyle constraints. How much time can you realistically dedicate to trading? Be honest – if you have 30 minutes a day, don’t try to become a scalper on 1-minute charts.

Next, consider your risk tolerance and capital size. Smaller accounts often benefit from shorter timeframes because they can build capital more quickly with smaller position sizes. Larger accounts might prefer longer timeframes to deploy capital more efficiently.

Finally, match your timeframes to your personality. If you’re naturally patient and prefer to make fewer, higher-conviction trades, swing trading on daily charts might suit you. If you thrive on action and quick decision-making, day trading could be your path.

The Technical Foundation

Regardless of your chosen timeframes, certain technical principles remain constant. Support and resistance levels that show up on weekly charts are more significant than those on 5-minute charts. Breakouts that occur on daily charts tend to be more reliable than those on hourly charts.

This doesn’t mean shorter timeframe signals are worthless – they’re just different tools for different jobs. Use them for fine-tuning entries and exits, but let the higher timeframes guide your overall direction.

Risk Management Across Timeframes

Your risk management approach should adapt to your timeframes. Day traders might risk 1-2% per trade because they’re making multiple trades daily. Swing traders might risk 2-5% per trade since they’re making fewer trades with longer hold periods.

The key is consistency. Whatever timeframe you choose, develop a systematic approach to position sizing, stop-loss placement, and profit-taking. Emotional decisions destroy accounts faster than bad technical analysis.

The Learning Curve

Expect a learning curve regardless of your chosen timeframe. Day trading requires developing quick decision-making skills and emotional control. Swing trading demands patience and the ability to ignore short-term noise. Long-term investing requires conviction and the ability to withstand significant drawdowns.

Start with paper trading or very small position sizes while you develop your skills. The market will always be there – there’s no rush to risk significant capital while you’re still learning.

Market Conditions and Timeframe Effectiveness

Different market conditions favor different timeframes. Trending markets work well for longer timeframes, while choppy, range-bound markets might favor shorter timeframes with quick entries and exits.

During crypto bull markets, longer timeframes often outperform because trends persist for months. During bear markets or sideways periods, shorter timeframes might be necessary to capture the smaller, shorter-lived movements.

Technology and Execution

Your chosen timeframes will influence your technology needs. Day traders need fast execution, multiple monitors, and reliable internet connections. Swing traders can get by with basic setups and mobile apps for monitoring positions.

Don’t over-engineer your setup for your actual trading style. A swing trader doesn’t need a $10,000 trading setup, and a day trader can’t succeed with just a smartphone app.

The Psychology of Timeframes

Different timeframes create different psychological pressures. Shorter timeframes create urgency and can lead to overtrading. Longer timeframes can create anxiety about missing moves or second-guessing positions.

Understand your psychological tendencies and choose timeframes that complement your natural behavior patterns. If you’re naturally impatient, forcing yourself into long-term investing might lead to poor decisions.

Practical Implementation

Once you’ve chosen your primary timeframes, develop a routine. Check your higher timeframes first thing in the morning for trend confirmation. Use your middle timeframes for identifying specific setups. Use your lower timeframes for precise entries and exits.

Keep a trading journal that notes which timeframes provided the best signals for your trading style. Over time, you’ll develop an intuitive feel for which timeframes work best in different market conditions.

The Bottom Line

There’s no universally “best” timeframe for crypto trading. The best timeframe is the one that matches your lifestyle, personality, and goals. Whether you’re scalping 1-minute charts or holding for months, success comes from consistency, risk management, and working with the trend rather than against it.

Start with longer timeframes to understand market structure, then work your way down to shorter timeframes for execution. Remember that higher timeframes trump lower ones – let the weekly chart guide your bias, the daily chart identify your setups, and the hourly chart fine-tune your execution.

Most importantly, be patient with yourself as you develop your skills. Timeframe mastery doesn’t happen overnight, but once you find your rhythm, you’ll have a significant edge in these volatile but profitable markets.

The crypto markets never sleep, but your timeframe choice determines how much sleep you get. Choose wisely, trade consistently, and let the charts tell you their story rather than forcing your own narrative onto them.

⏰ Trading Timeframes Mastery

Master the Art of Multi-Timeframe Analysis in Crypto Trading

🎯 Find Your Perfect Trading Style

The truth about timeframes: there’s no magic bullet. But there IS a perfect match for your lifestyle, personality, and goals.

What’s Your Trading Lifestyle?

🚀 The Three Pillars of Trading Styles

Timeframes: 1m, 5m, 15m, 1h

Hold Time: Minutes to hours

Pros: Quick profits, defined risk

Cons: High stress, needs full attention

Skill Required: Expert

Timeframes: 4h, 1D, 1W

Hold Time: Days to weeks

Pros: Less stressful, good work-life balance

Cons: Slower profits, overnight risk

Skill Required: Intermediate

Timeframes: 1W, 1M

Hold Time: Months to years

Pros: Minimal time commitment, trend following

Cons: Large drawdowns, requires patience

Skill Required: Beginner to Intermediate

🔍 Multiple Timeframe Analysis

Professional traders never look at just one timeframe. Here’s how to stack them like a pro:

The Timeframe Hierarchy

Purpose: Major trend direction

Signal: Bullish uptrend

Purpose: Entry zones & patterns

Signal: Pullback opportunity

Purpose: Precise entry timing

Signal: Bounce confirmed

✅ The Golden Rule

Higher timeframes ALWAYS trump lower timeframes. If weekly is bullish but hourly is bearish, you’re still looking for buying opportunities, not selling ones!

⚖️ Timeframe vs Risk Management

| Trading Style | Primary Timeframes | Risk Per Trade | Win Rate Needed | Best For |

|---|---|---|---|---|

| Scalping | 1m, 5m | 0.5-1% | 65%+ | Full-time focus |

| Day Trading | 15m, 1h | 1-2% | 55%+ | Active traders |

| Swing Trading | 4h, 1D | 2-5% | 45%+ | Part-time traders |

| Position Trading | 1W, 1M | 5-10% | 35%+ | Patient investors |

🎮 Interactive Timeframe Simulator

Market Scenario: Bitcoin Weekly Uptrend

Bitcoin has been in a strong weekly uptrend. Today it pulled back 5% on the daily chart. What’s your move?

⚠️ Common Timeframe Mistakes

🚫 The “Clever Money” Trap

Mistake: Trying to short a weekly uptrend because “it’s gone too far”

Reality: Trends last longer than most people expect. Respect the higher timeframe!

🚫 The Timeframe Confusion

Mistake: Letting lower timeframes override higher timeframe signals

Reality: A red hourly candle in a weekly uptrend is noise, not a reversal signal!

🚫 The Overtrading Trap

Mistake: Day trading with only 30 minutes available daily

Reality: Match your timeframes to your available time and attention!

📚 Practical Implementation Guide

1. Check weekly charts for major trend

2. Review daily charts for setups

3. Use hourly for entry timing

4. Set alerts and walk away

Weekly → Trend direction

Daily → Support/Resistance

4H → Pattern confirmation

1H → Entry precision

Higher Timeframes: Larger positions

Lower Timeframes: Smaller positions

Rule: Risk less when timeframes conflict

Max Risk: Never exceed your daily limit

🧠 Psychology of Different Timeframes

| Timeframe | Psychological Challenge | Required Mindset | Success Factor |

|---|---|---|---|

| 1-15 Minutes | FOMO, Overtrading | Laser focus, quick decisions | Emotional control |

| 1-4 Hours | Impatience, Second-guessing | Patience within urgency | Disciplined execution |

| Daily | Overnight anxiety | Trust in analysis | Risk management |

| Weekly+ | Missing short-term moves | Long-term vision | Conviction & patience |

🔧 Technology Requirements by Timeframe

✅ Multiple monitors

✅ Fast internet (fiber)

✅ Level 2 data

✅ Advanced charting software

✅ VPS for reliability

Budget: $2,000-$10,000+

✅ Single monitor setup

✅ Standard internet

✅ Basic charting platform

✅ Mobile app for monitoring

✅ Price alerts

Budget: $500-$2,000

✅ Laptop/tablet sufficient

✅ Basic internet

✅ Simple charting tools

✅ Portfolio tracking app

✅ News alerts

Budget: $0-$500

📈 Market Conditions & Timeframe Effectiveness

When Each Timeframe Works Best

| Market Condition | Best Timeframes | Why It Works | Avoid |

|---|---|---|---|

| Strong Trending | Daily, Weekly | Trends persist longer | Fighting the trend |

| Range-Bound | 1H, 4H | Quick reversals at levels | Long-term positions |

| High Volatility | 15m, 1H | Capture quick moves | Tight stops |

| Low Volatility | Daily, Weekly | Wait for breakouts | Scalping |